Active

Role

Role

Peek at my latest and greatest

projects in my current role!

projects in my current role!

What are my main responsibilities?

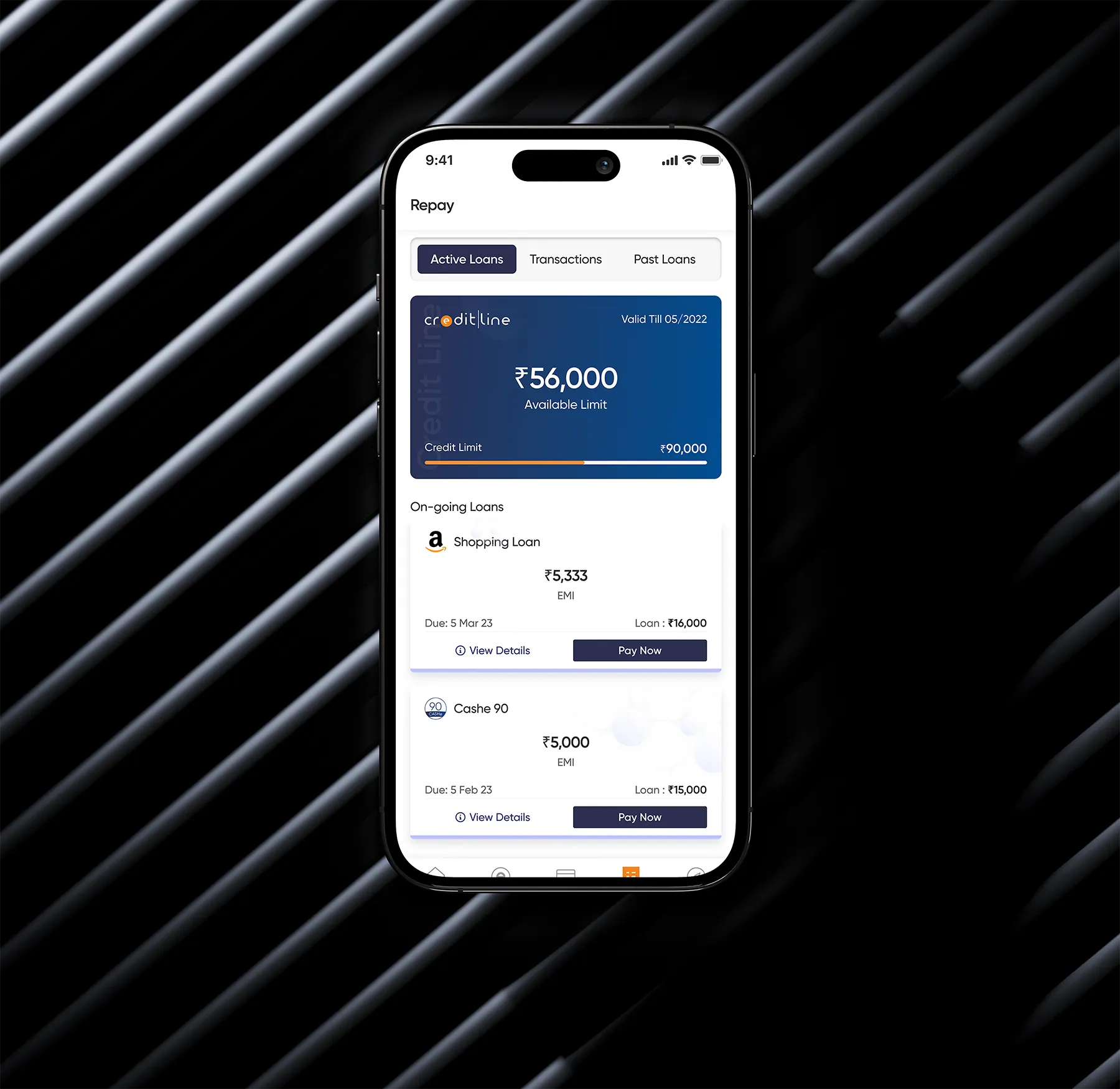

I currently serve as the Head of Product Design at CASHe, a platform that provides loans tailored for young millennials.

I am committed to creating the user interface and interaction for our valued users on a regular basis.

My main responsibility as a design leader for both Android and iOS teams is to ensure that every CASHe platform provides a top-notch lending and disbursal experience.

Google Pay Lending

What is this about

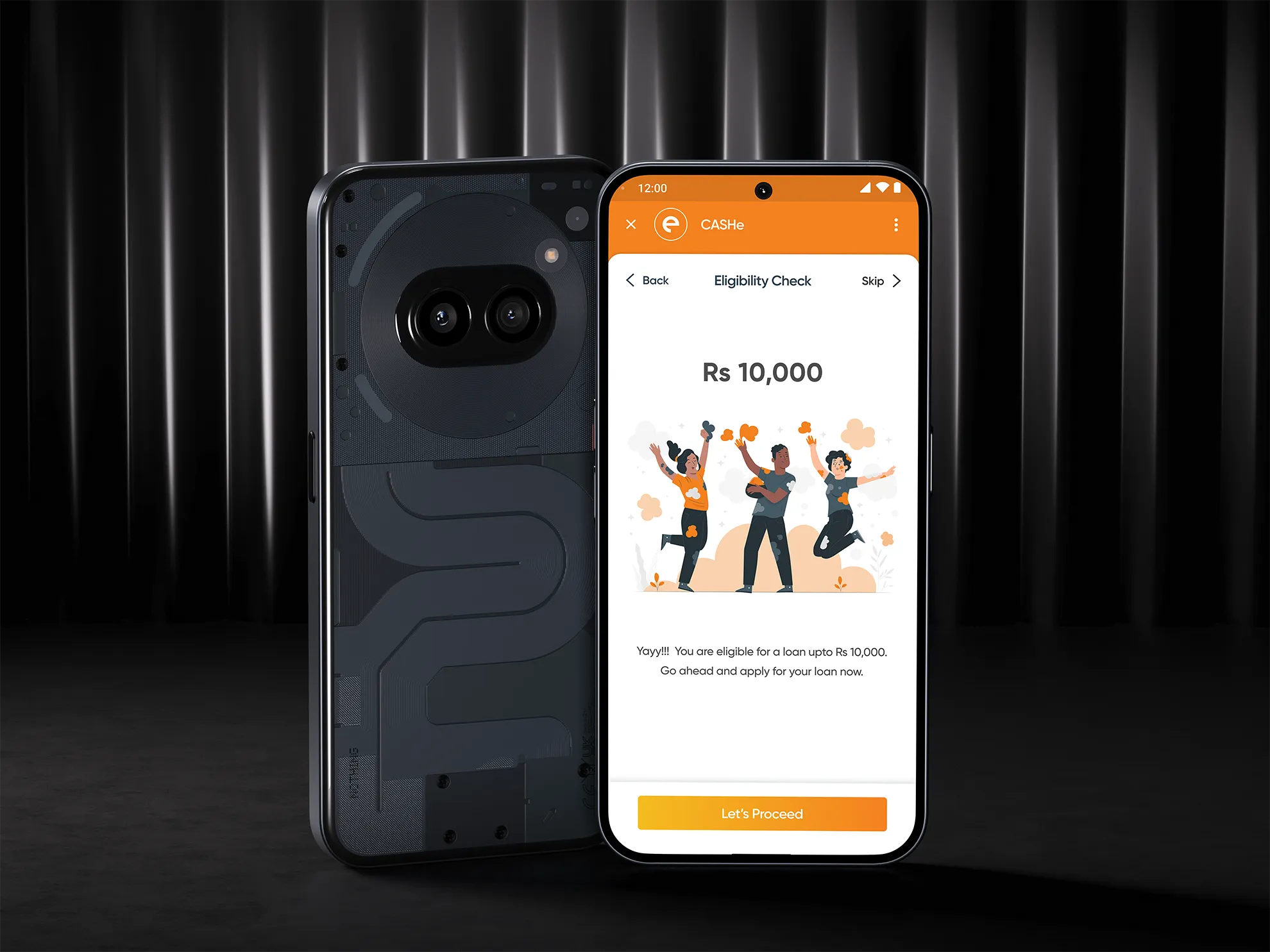

In the marvellous era of UPI, a fascinating revolution occurred, making payment platforms like PhonePe, PayTM, and GPay all the rage. When the pandemic swept across the globe, people found themselves in dire need of credit.

It was during this opportune moment that we seized the chance and introduced embedded lending. Collaborating with GPay, we embarked on an extraordinary endeavour, granting users the convenience of obtaining small unsecured loans without requiring them to download our platform.

In this, we seamlessly integrated our entire lending journey within the remarkable world of Google Pay itself. Our aim was to make borrowing a breeze, ensuring a delightful experience for our valued users.

It was during this opportune moment that we seized the chance and introduced embedded lending. Collaborating with GPay, we embarked on an extraordinary endeavour, granting users the convenience of obtaining small unsecured loans without requiring them to download our platform.

In this, we seamlessly integrated our entire lending journey within the remarkable world of Google Pay itself. Our aim was to make borrowing a breeze, ensuring a delightful experience for our valued users.

What was my role

Being my inaugural project at CASHe, I held exclusive responsibility for the initial ideation and wire-framing. This encompassed meticulous consideration of various side and edge cases, leading to the culmination of final designs. Subsequently, I conducted testing with real users to ensure the efficacy and user-friendliness of the developed designs.

CASHe's embedded lending is being discussed all over in our Bangalore office.

Google Head, India

Offline QR Code Journey

What is this about?

Groceries represent a crucial portion of customers' monthly expenses. Through CASHe Khaata book, we enable customers to make payments at local grocery stores using their credit line. This emulates the traditional practice of maintaining an account, with local stores.

When an active CASHe customer with a Credit Line visits the store and selects groceries, they can complete the purchase by scanning the store's QR code at the checkout. This action initiates a web or in-app journey where the customer enters their mobile number and the purchase amount.

After entering the required information, the customer receives a final confirmation prompt. Upon consent, CASHe processes the payment, transferring the funds to the shopkeeper's account. The equivalent amount from the customer's credit limit is utilized for this transaction.

A confirmation of the payment is then shared with the customer, and the transaction details are reflected in the CASHe app.

A confirmation of the payment is then shared with the customer, and the transaction details are reflected in the CASHe app.

QR Journey In Action

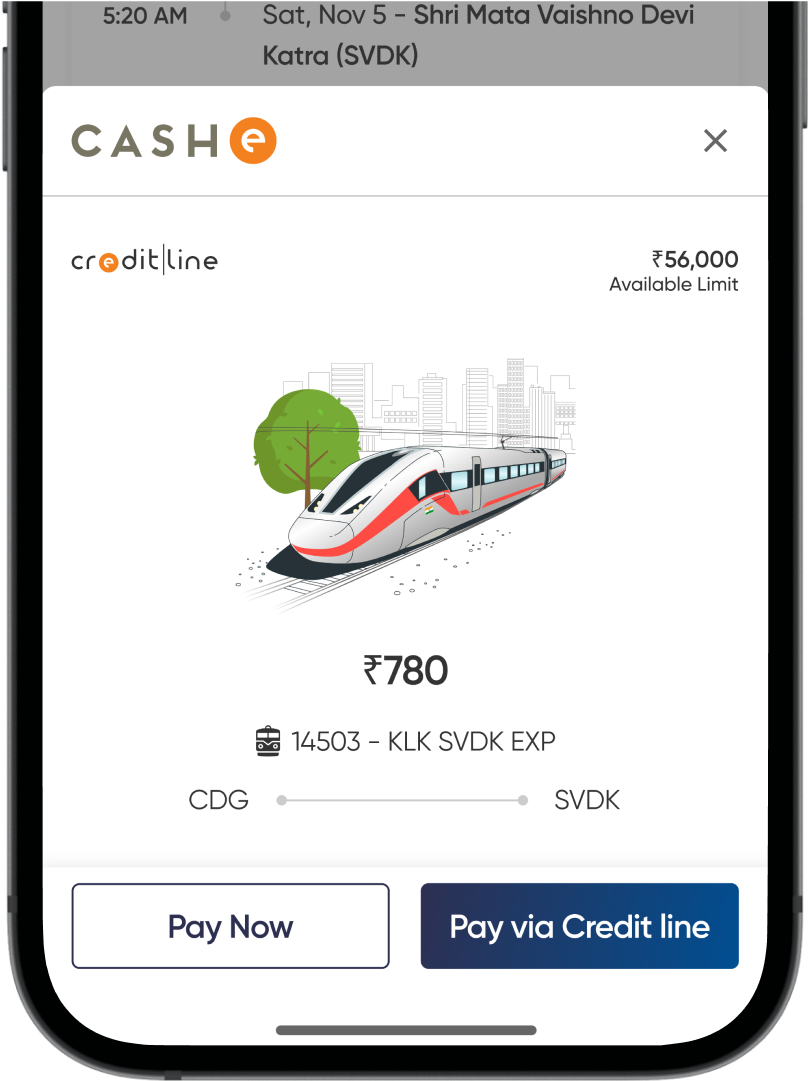

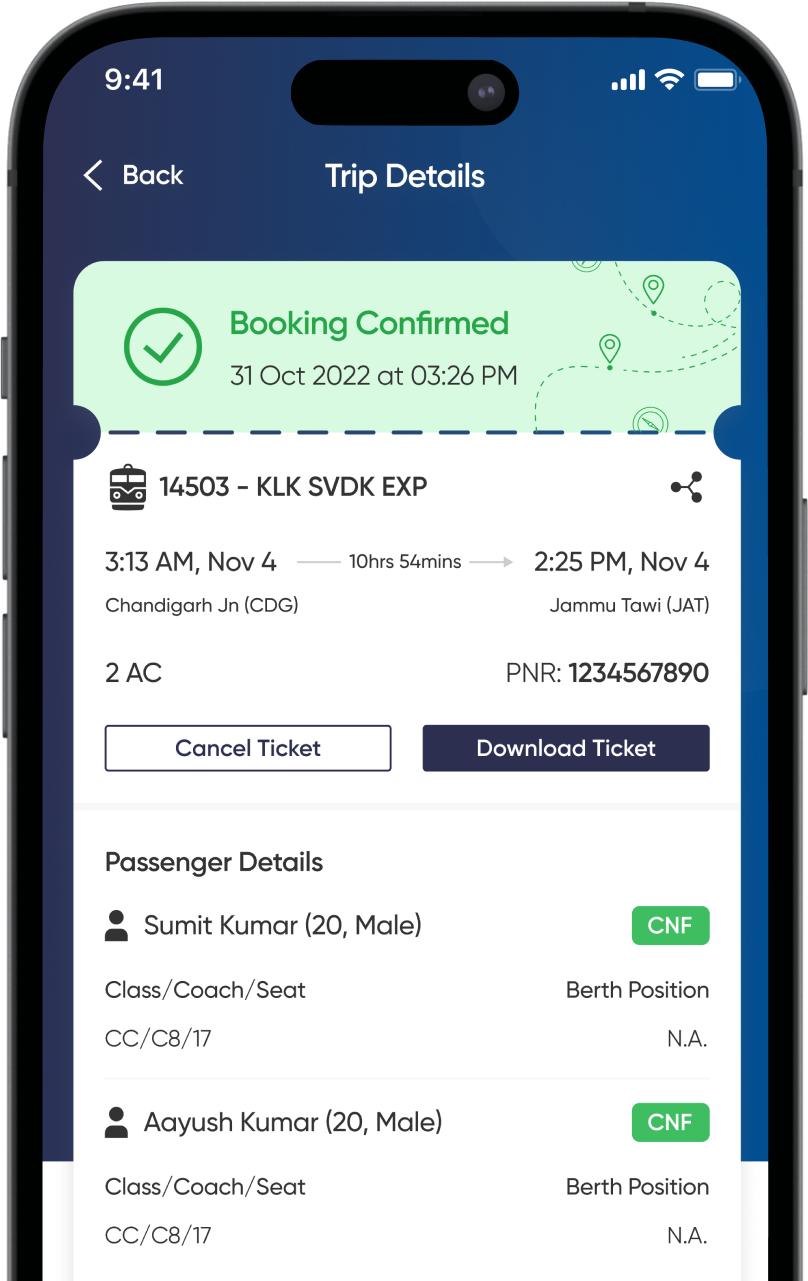

IRCTC - Lending for Train Ticket

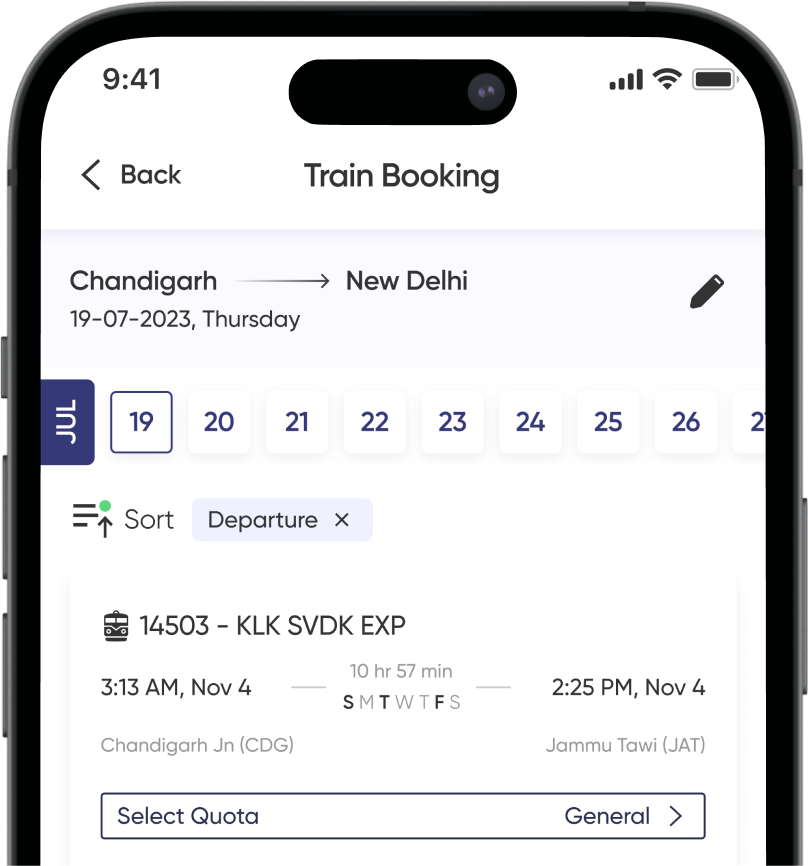

CASHe has forged a strategic alliance with the Indian Railway Catering and Tourism Corporation (IRCTC) to facilitate the provision of small, low-value disbursal loans for train ticket bookings.

In this collaboration, CASHe is furnishing the ticket booking platform for customers. On the concluding checkout page, users are presented with the choice to utilize CASHe's credit line.

This allows customers to seamlessly book train tickets on the go without an immediate payment requirement. Repayment can be effortlessly managed through small investments.

This allows customers to seamlessly book train tickets on the go without an immediate payment requirement. Repayment can be effortlessly managed through small investments.

Our service encompasses all categories of train tickets, catering to diverse preferences—from General class to First class, accommodating both individuals and their family members.

Input your boarding station and destination with date and time for your train journey.

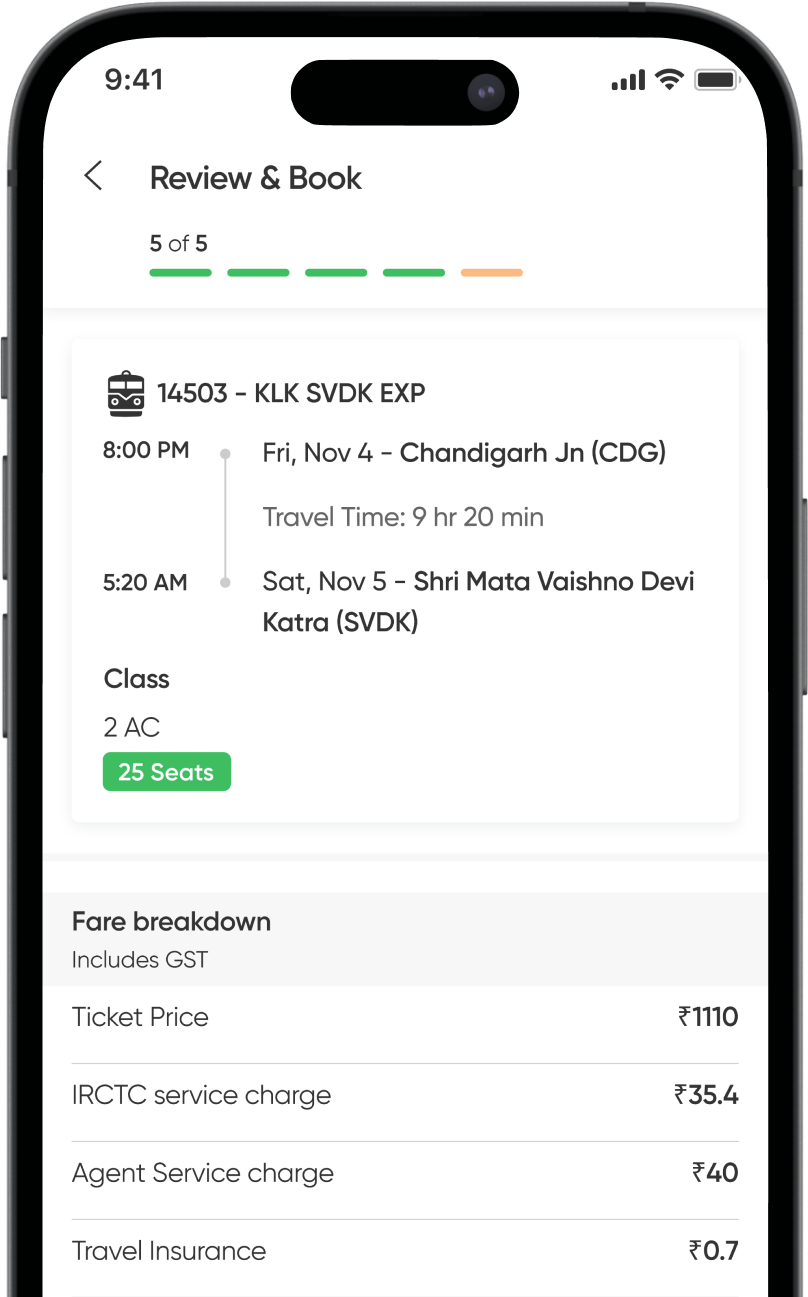

All train selection and payment details are provided. We have invested significant effort to enhance our core offerings, ensuring an improved and refined experience.

On the final payment screen, users have the option to receive instant credit. This feature streamlines the payment process and enhances user convenience.

After booking, users receive a detailed version of their ticket, ensuring they have all necessary information for their journey.

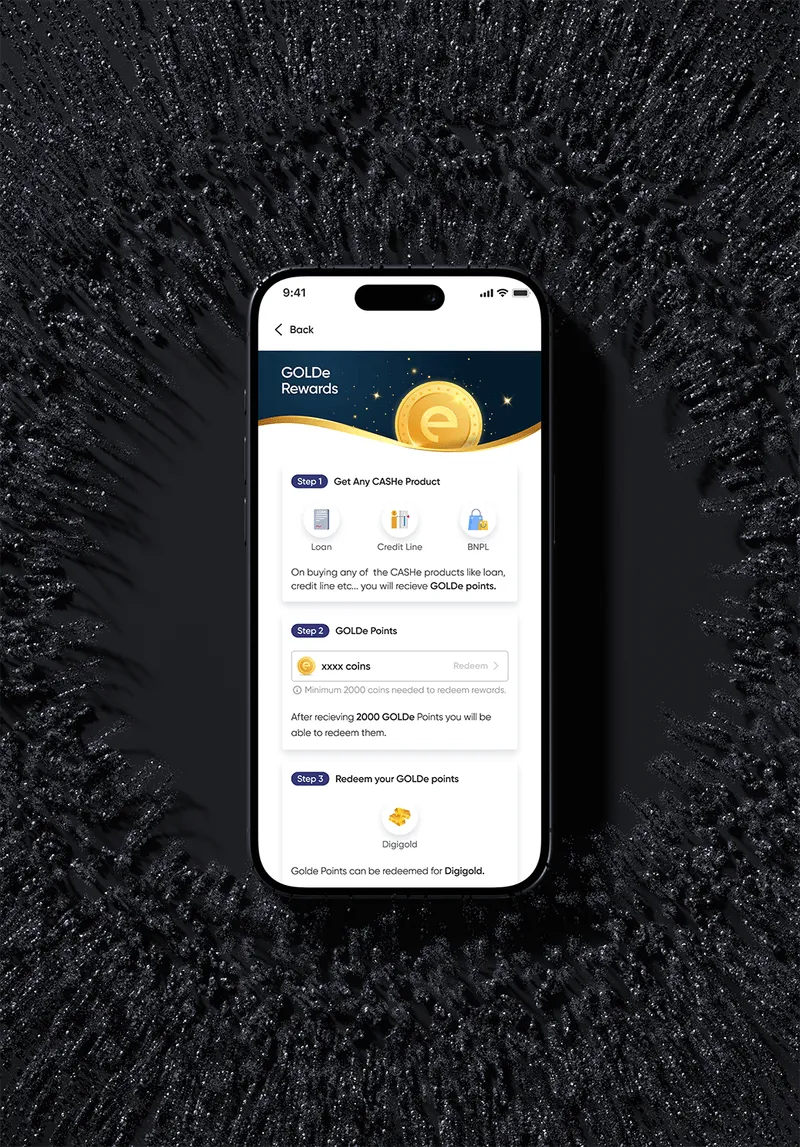

GOLDe

Rewarding users with Digital Gold

We are exploring the possibility of providing notional gold (GOLDe) as a primary reward for customer transactions. With GOLDe, customers can redeem accumulated units for the equivalent value in gold, including additional bonus gold.

This redemption becomes available once the customer surpasses a specified minimum threshold of accumulated GOLDes.

How does it work

This transparency allows users to monitor their gold holdings, enabling them to make informed decisions based on real-time market conditions.

By consolidating all gold-related activities in one accessible location, the Gold Locker enhances the user experience, offering a holistic perspective on their gold portfolio. Users can leverage this valuable tool to track the performance and value of their gold assets, contributing to a more informed and empowered financial experience on the CASHe platform.

Checking Credit Score

Credit Score is individual's creditworthiness

With that being stated, the development encompasses the introduction of a feature on the CASHe Mobile App. This feature enables registered CASHe customers to access their Credit Score, as provided to CASHe by Equifax, along with a detailed analysis. The implementation of this feature serves the following purposes for CASHe

What were the key features of this product

Increase Login

Increase number of logins and active users on a periodic basis

Engaging Customers

Act as a hook for customers to opt for CASHe products (Loan, Credit Line, Insurance)

One Stop Point

Position CASHe as one-stop point for any personal credit requirements & information

CASHe Design System

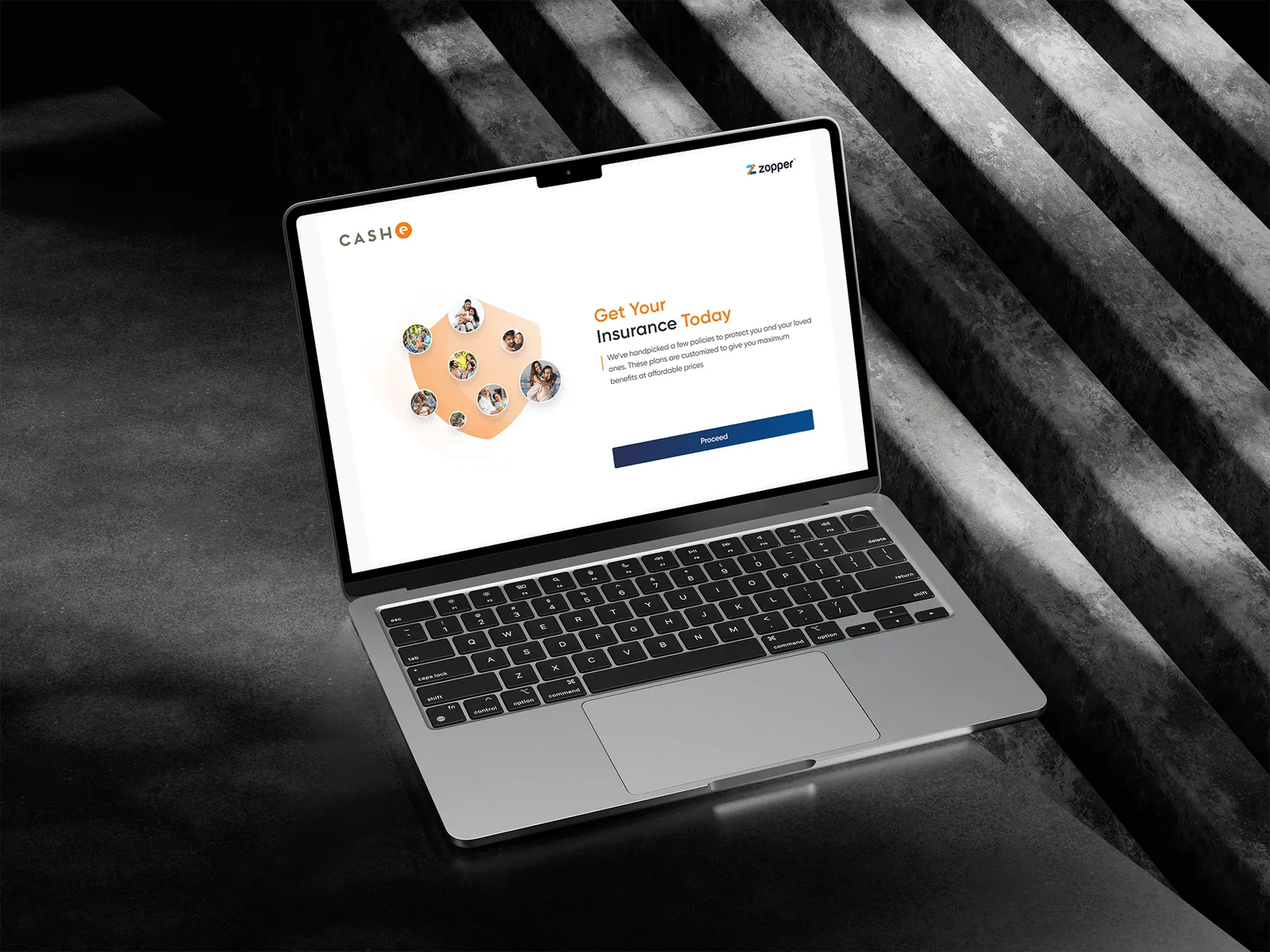

Our current integration with the insurance distribution platform, Zopper, aims to monetize our dormant user base and generate supplementary revenue for CASHe. To facilitate this, we are considering the inclusion of a microsite within the app. In an ideal scenario, users seamlessly access the microsite from the app interface, creating a streamlined pathway for exploring and potentially engaging with insurance offerings.

This strategic approach not only enhances user experience but also aligns with our business objective of diversifying revenue streams through cross-selling insurance services to our user base.

This strategic approach not only enhances user experience but also aligns with our business objective of diversifying revenue streams through cross-selling insurance services to our user base.

Zopper Insurance

We integrated with the insurance distribution platform, Zopper to monetize our dormant user base and generate supplementary revenue for CASHe. To facilitate this, we included a microsite within the app. In an ideal scenario, users seamlessly access the microsite from the app interface, creating a streamlined pathway for exploring and potentially engaging with insurance offerings.

Rent & Education Payment

We have successfully integrated rent and education payment functionalities to enhance user experience. This strategic addition aims to provide our users with comprehensive capabilities, ensuring seamless management of essential expenses.